Admin and Finance

Budget Office

The role of the Budget Office at Coppin State University is to provide financial support to all departments within the university. This support includes managing and allocating the university's financial resources, developing, and monitoring budgets, and ensuring compliance with financial regulations and policies. In addition to these responsibilities, the Budget Office also works collaboratively with other departments and Stakeholders to achieve the overall mission of the university. This may involve coordinating financial resources and strategies with academic departments, students services, and other administrative units to support the university's goals and objectives. Overall, the Budget Office plays a critical role in ensuring that the university's financial resources are effectively managed and utilized to support the mission of the institution, which includes providing high-quality education, research, and community service to its students and surrounding community.

The Budget Office works in accordance with all applicable laws and regulations, and refers to budget preparation guidance from:

Budget Allocation

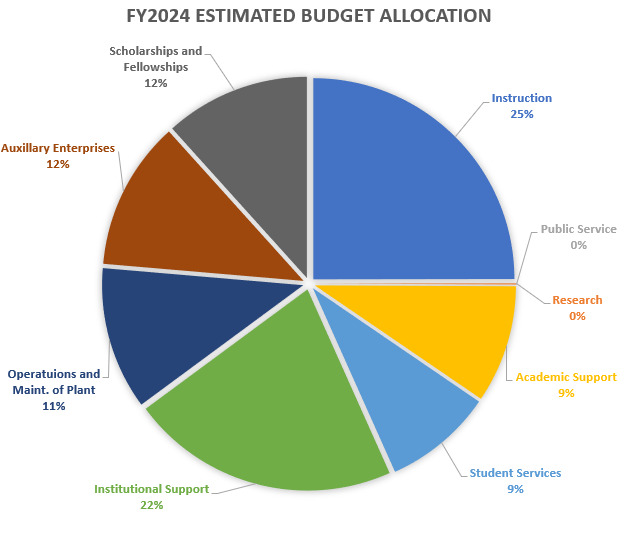

FY 2024 Estimated Budget Allocation

- Instruction 25%

- Research 0%

- Public Service 0%

- Academic Support 9%

- Student Services 9%

- Institutional Support 22%

- Operations and Maint. of Plant 11%

- Axillary Enterprises 12%

- Scholarships and Fellowships 12%

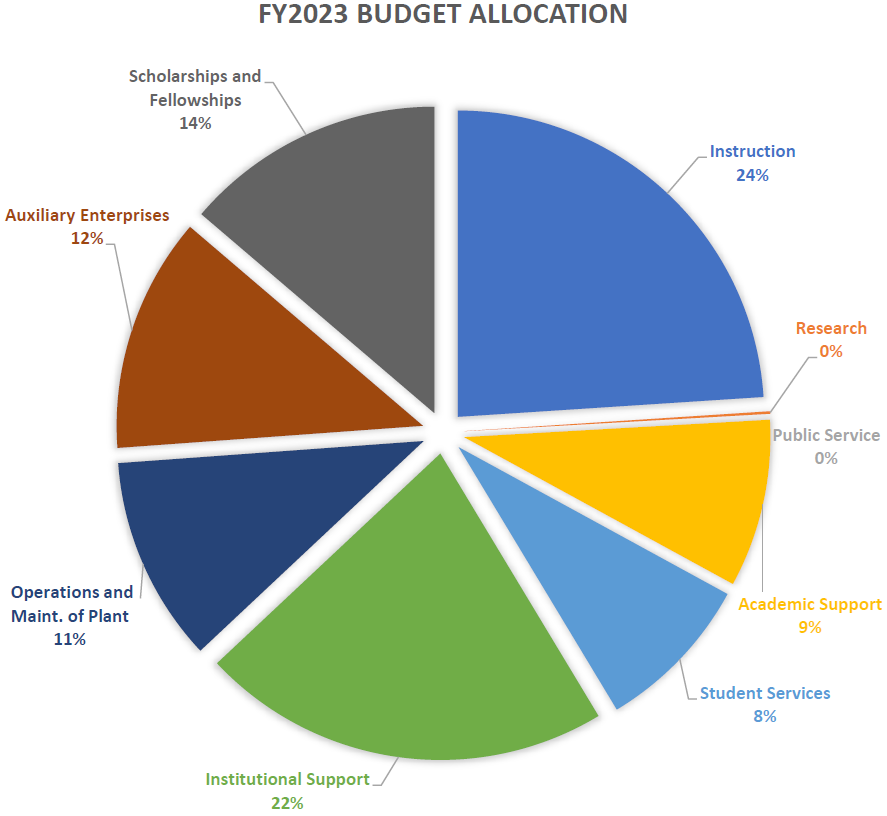

FY 2023 Budget Allocation

- Instruction 24%

- Research 0%

- Public Service 0%

- Academic Support 9%

- Student Services 8%

- Institutional Support 22%

- Operations and Maint. of Plant 11%

- Axillary Enterprises 12%

- Scholarships and Fellowships 14%

Budget by Fiscal Year

Operating Budget Cycle/Calendar

| Month | CSU |

USM/State (and other USM reports as requested) |

|---|---|---|

|

March |

A & F conducts revenue estimates;submits base budget allocations to VPs |

Room, Board, and Parking fee amounts are due |

|

April |

|

Budget decisions finalized by General Assembly and USM |

|

May |

Internal budget discussions between A & F and each VP; completion of budget forms by each VP |

Budget Amendment processed (if needed) |

|

May/June |

Compilation of budget for final review by VPAF prior to being loaded in PeopleSoft |

Tuition and Fee rates are finalized by BOR |

|

June |

Departmental budgets are loaded into PeopleSoft |

|

|

June/July |

|

Preliminary Budget info for State-Supported working budget |

|

July/August |

Actual expenditure analysis |

|

|

August/September |

|

Budget instructions from USM for the next fiscal year |

|

September/October |

|

Operating budget submission for the next fiscal year; Target reduction plan submission (if required) |

|

December |

Mid-Year Budget Analysis/Review |

|

|

January |

Prepare draft of tuition and mandatory fees for next fiscal year |

|

|

January/February |

|

Frequently Asked Questions (FAQ)

In PeopleSoft Financials: Commitment Control -> Review Budget Activities -> Budget Overview

- In PeopleSoft Financials: Commitment Control -> Budget Report -> Budget Transaction Detail

- In PeopleSoft Financials: Purchasing -> Purchasing Orders -> Reports -> Review PO Information -> Document Status

- In PeopleSoft Financials: Purchasing -> Purchase Orders: -> Reports -> Req and PO Budgetary Activity

- In PeopleSoft Financials: Purchasing -> Purchase Orders: -> Reports -> Req and PO Budgetary Activity